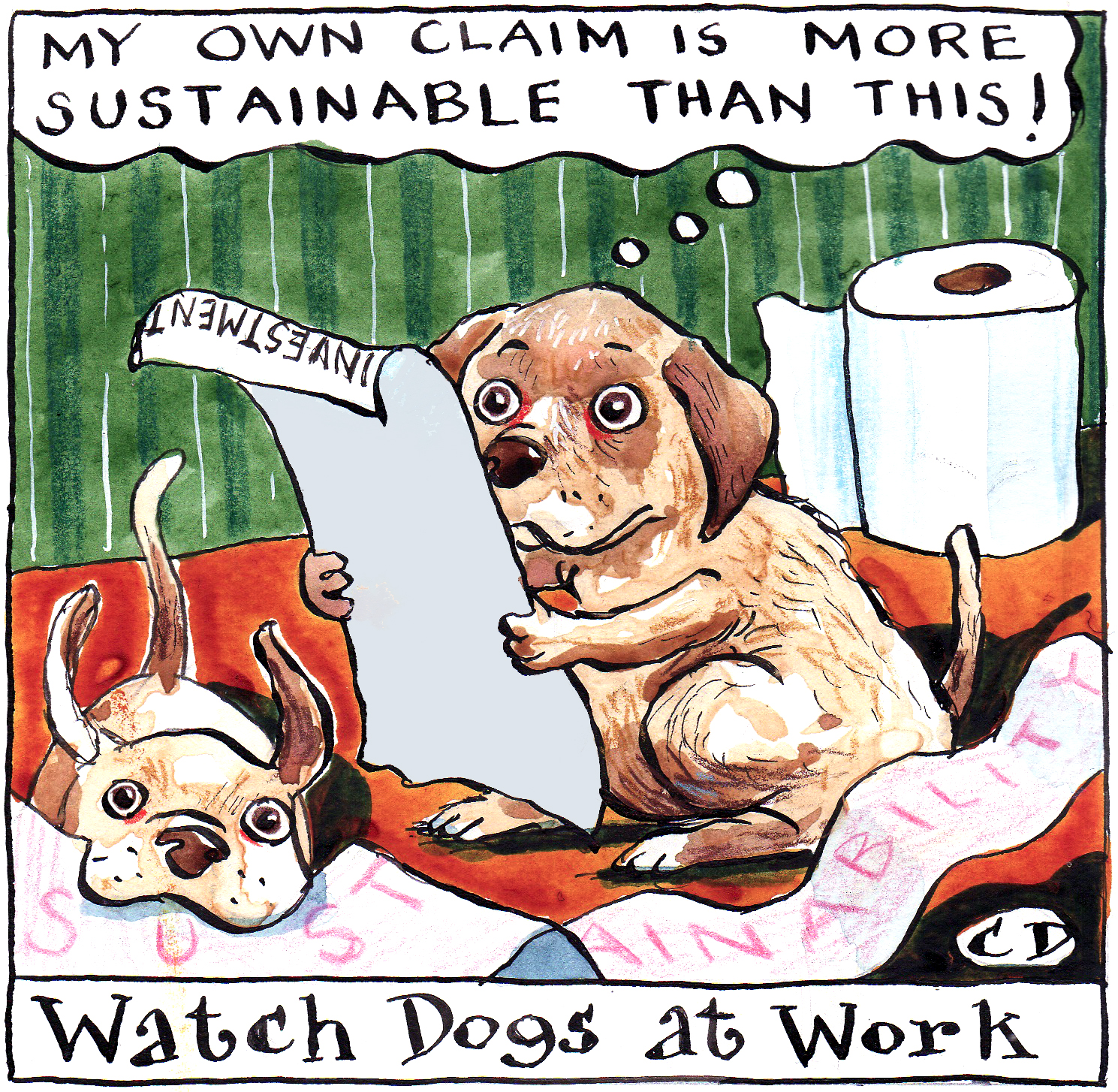

Addressing Greenwashing in Investment Funds: A Sustainable Approach?

The modern era faces a significant issue with misleading sustainability claims. Everything, it seems, comes with a sustainability label. For instance, the Sustainable Coal Stewardship program run by FutureCoal aims to present coal mining in an eco-friendly light. Recently, Virgin Atlantic faced scrutiny from the Advertising Standards Authority for exaggerated assertions regarding its sustainable aviation fuel. Even Japanese marine scientists are advocating for sustainable whaling, which raises questions about the definition of sustainability.

Sustainability has become more of a marketing buzzword than a genuine concept. When every product is touted as sustainable, the term loses its meaning, especially for investors attempting to navigate this landscape. Determining the true environmental credentials of different fund managers can be daunting. Even dedicated green investors may find it challenging to trace where a fund’s money ultimately goes, let alone the rationale behind each investment decision.

Consider the debate over owning shares in major oil companies like BP and Shell within a sustainable investment framework. Some argue that maintaining investments in these firms is necessary to facilitate their transition to greener energy solutions. Others counter that supporting fossil fuel companies undermines sustainable investing.

The Financial Conduct Authority (FCA), the UK’s investment fund regulator, is taking steps to curb greenwashing among funds. Two years ago, they outlined a straightforward plan: funds would need to minimize the use of vague sustainability labels like “sustainable” and “impact” and only employ them under three specific categories, necessitating proof of compliance with set criteria.

After an extensive consultation process, the FCA has finalized four categories for fund labeling. Since July 31, funds have been able to notify the FCA of their intent to adopt these labels, with a grace period ending on December 2. After this date, terms like “sustainable,” “sustainability,” and “impact” will be prohibited unless funds have completed the necessary steps to qualify.

Progress, however, has been slow. Inquiries made to the FCA yielded vague results, with indications that only a limited number of funds have taken the initiative to register. Reports suggest that only around six funds have actively engaged in the application process.

To qualify for one of the labels, funds must adhere to specific standards. The first category, Sustainability Focus, requires that at least 70% of a fund’s investments be in assets deemed “environmentally and/or socially sustainable.” However, simply declaring this is insufficient; funds must provide substantial evidence demonstrating their sustainability practices.

The second label, Sustainability Improvers, applies to funds investing 70% in assets that have the potential for environmental or social improvement over time, which must also be supported by verifiable evidence.

The third category, Sustainability Impact, targets funds that explicitly aim for defined positive impacts on environmental or social metrics and demand proof of commitment alongside a clear theory of change, which may necessitate consulting services.

The final label, Sustainability Mixed, was introduced to accommodate multi-asset funds. This broader classification allows for investment diversification while still adhering to sustainability goals, requiring funds to meet certain benchmarks corresponding to the other labels.

For many fund managers accustomed to categorizing their offerings as “sustainable” without rigorous scrutiny, this transition may prove challenging. The shift demands detailed evidence and validation that aligns fund activities with genuine sustainability practices, complicating previous approaches that often justified higher fees without substantial backing.

Some might be tempted to flout these regulations and misuse the labels; however, the FCA maintains that firms adopting a label are responsible for its accuracy and relevance. The regulator has stated they will investigate compliance issues as they emerge.

The path forward remains uncertain. Should the FCA set overly ambitious standards, we may see a sharp decline in the number of recognized environmental funds. Conversely, existing funds that manage to comply could attract significant investments, especially given survey results indicating that 80% of savers wish for their funds to have a positive social and environmental impact.

In conclusion, a significant reduction in the number of compliant funds seems unlikely. Fund managers are likely to adapt their strategies rather than risk exclusion from a lucrative market segment, despite the increased costs associated with compliance. Given the slow pace observed thus far, a surge in applications is anticipated as the deadline approaches.

Dominic OConnell is a business presenter for Times Radio

Publicar comentario